Study Historical Defensive Stock Performance

Learn About Recession-Resistant Sectors

Join 7,400+ Members Learning Risk Management

Join Defensive Strategy Education Group

Historical example. Not a prediction. Defensive stocks can also lose value.

This Week's Learning Focus

Understanding Defensive Sectors

Educational examples of defensive sectors (Healthcare, Utilities, Consumer Staples):

Healthcare (JNJ)

Essential services with stable demand

Consumer Staples (WMT, PG)

Non-discretionary goods consumption

Educational examples - Not recommendations

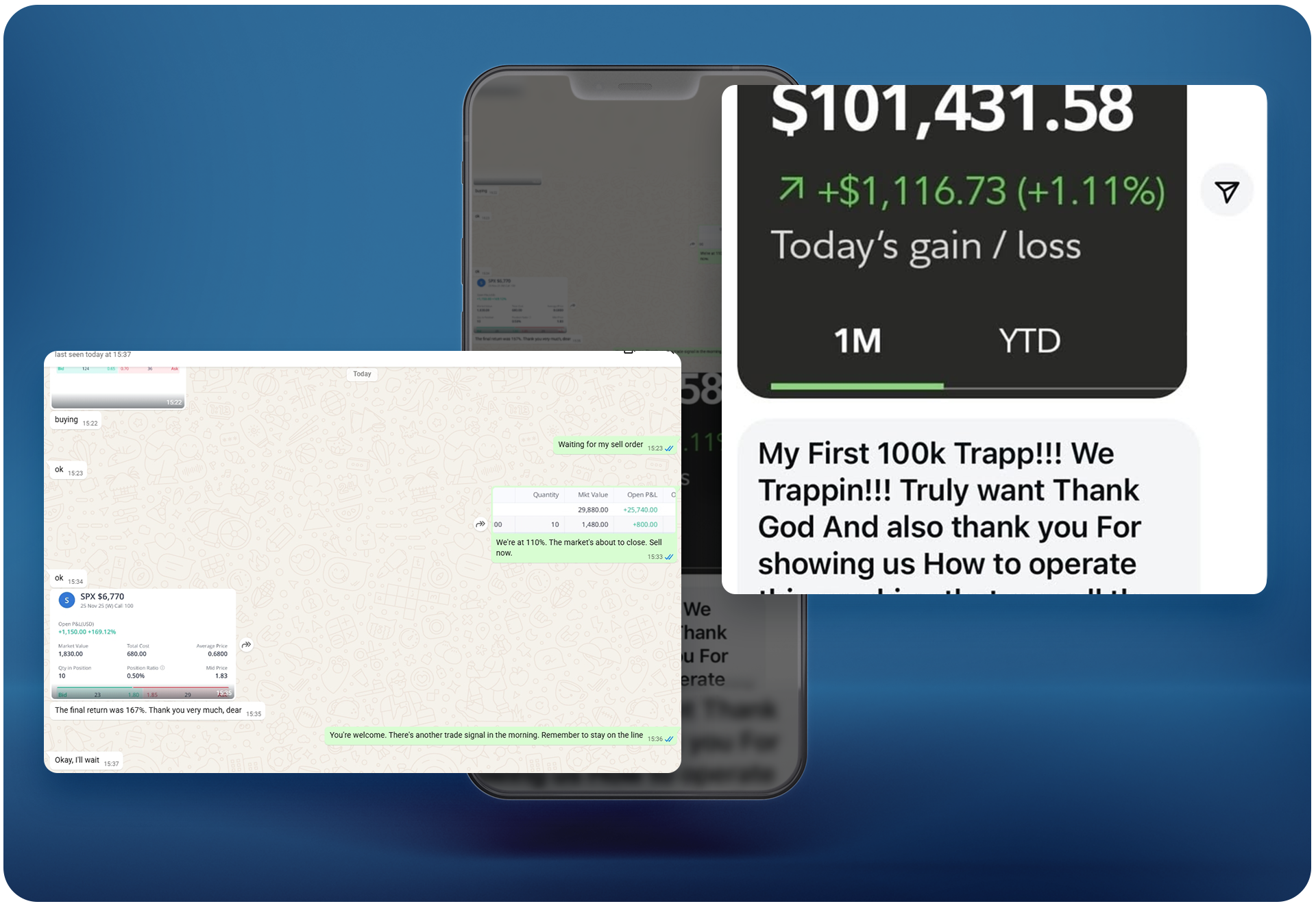

Educational examples only - Not typical results

Aero Engineer, 48

📅 Jul 2024

📚 EXAMPLE ONLY

Educational purpose - Not typical

Ops Manager, 59

📅 Jun 2024

📚 EXAMPLE ONLY

Educational purpose - Not typical

Principal, 54

📅 May 2024

📚 EXAMPLE ONLY

Educational purpose - Not typical

RE Agent, 56

📅 Apr 2024

📚 EXAMPLE ONLY

Educational purpose - Not typical

CRITICAL DISCLAIMER:

These are hypothetical learning journeys for educational purposes only. No strategy can eliminate investment losses. Defensive stocks can also decline significantly. Past market conditions do not predict future outcomes. Individual results vary widely. Consult a licensed financial advisor before investing.

Historical Case Study

"2025 Market Volatility"

Educational Reference Only

Historical Analysis

Case study examining defensive sector performance during 2024 market correction period ⚠️ Past ≠ Future. Not a guarantee.

"This group helped me understand defensive sector analysis. The educational materials are thorough and practical."

"After 2008, I wanted to learn about risk management. This education gave me better understanding of defensive investing."

"Great educational resource for learning about defensive stock strategies. Clear explanations and good examples."

Learn Risk Management Concepts

Study Defensive Sector Characteristics

Understand Portfolio Diversification

Case Studies & Historical Analysis